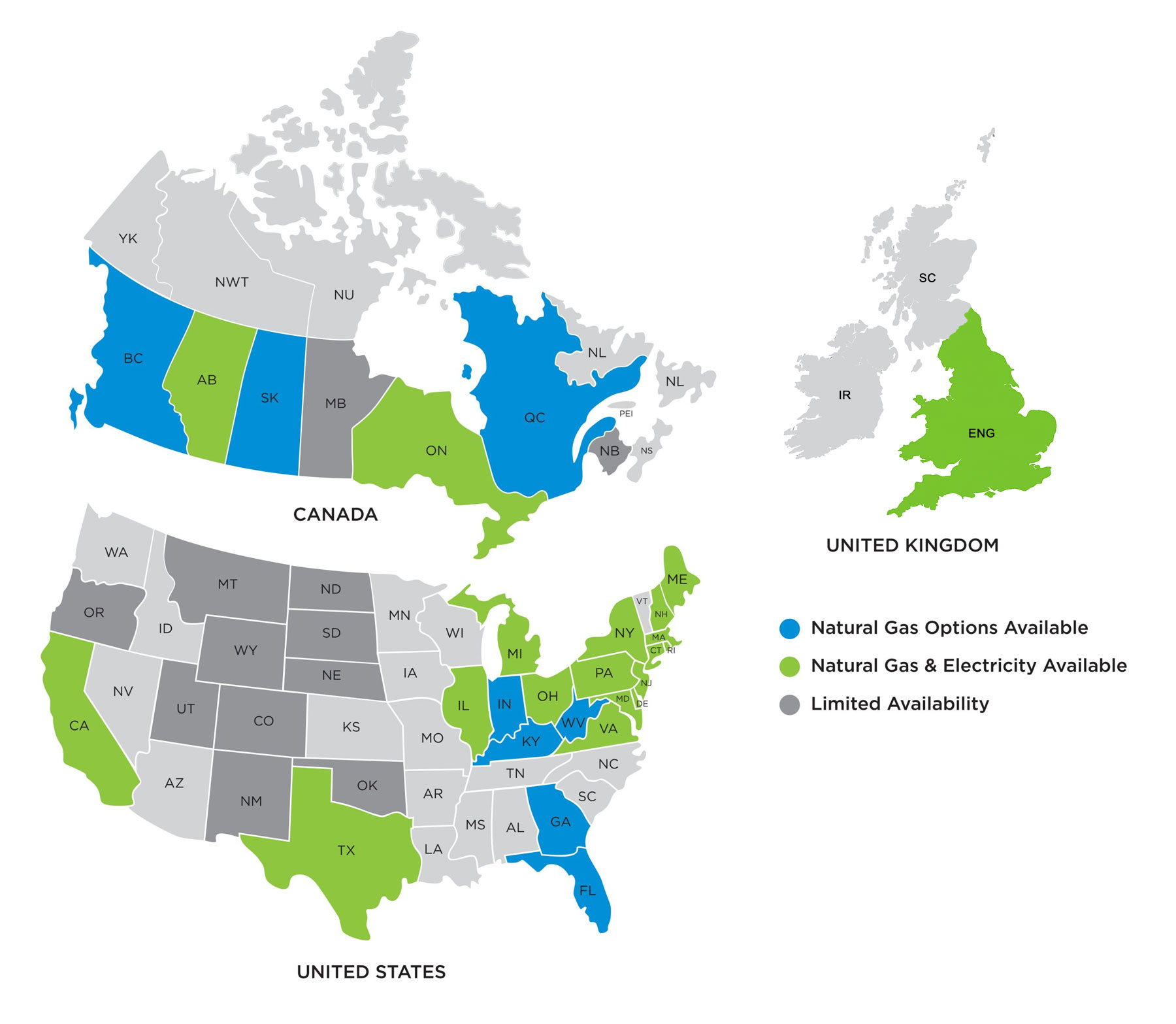

We service all deregulated markets in North America as well as the UK

with the ability to price 100+ energy suppliers including producer direct options.

Onterra® Energy Advisors secures natural gas and electricity price bids from over 100 energy retailers, wholesalers and producer direct options servicing mid and large-size commercial businesses in all deregulated markets in North America and the UK.

We provide strategic solutions for our clients including 100% market, partially fixed and fully fixed price options that align with market fundamentals and client objectives as well as providing active and ongoing account reviews to ensure our clients have opportunities to buy when the market is favorable.

Why Use an Energy Broker?

A valuable energy broker will work with true wholesale suppliers and shop every single transaction for the best pricing available. That’s because no single supplier always has the best price all of the time in every single market.

Brokers help their client determine the best supply and product options keeping in mind the client’s business objectives as well as their risk tolerance.

At Onterra®, our low-margin pricing combined with our ongoing active account management is key to our client’s success. We don’t just sign the contract and call you when it’s about to expire, we review your account every 3 to 4 months throughout the term and advise you of appropriate buying opportunities in advance relying on sound market fundamentals which we supply to you in an easy-to understand format.

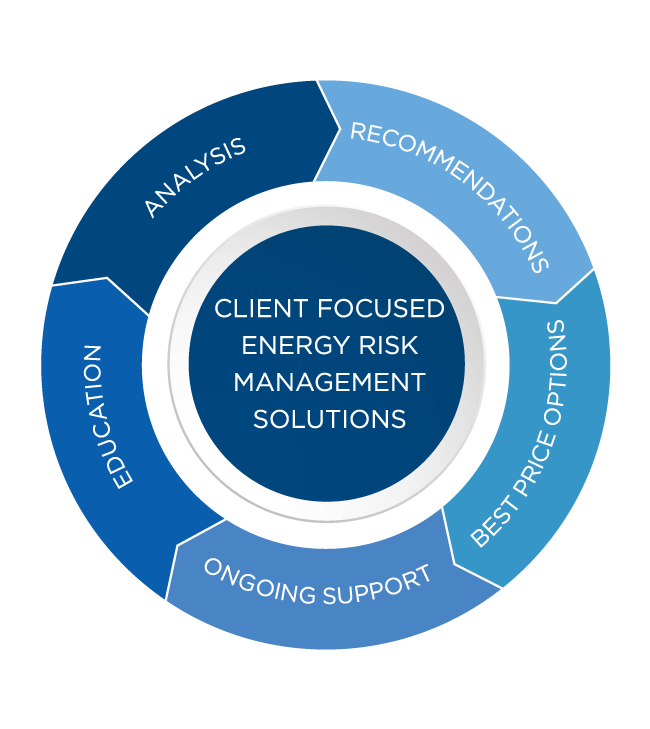

The Process

- Initial call or Teams/Zoom meeting to best understand the client's business objectives

- Data collection and analysis to determine best options.

- Present options and include either savings or cost comparison depending on program, shop for best pricing.

- Review options including market data / conditions necessary for a fully informed decision.

- Refresh pricing/ options and execute.

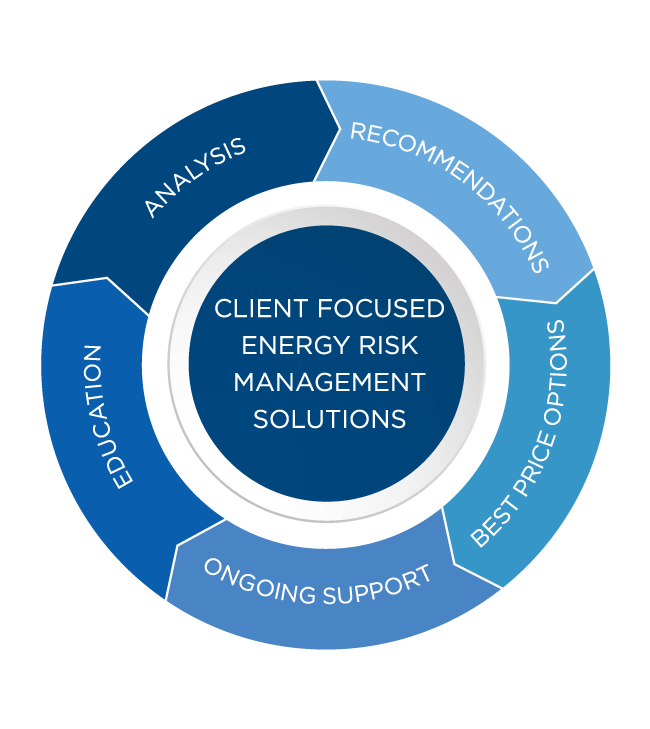

The Process

- Initial call or Teams/Zoom meeting to best understand the client's business objectives

- Data collection and analysis to determine best options.

- Present options and include either savings or cost comparison depending on program, shop for best pricing.

- Review options including market data / conditions necessary for a fully informed decision.

- Refresh pricing/ options and execute.

Our Commitment

We ensure our clients are fully informed of the market fundamentals prior to signing an agreement. We ensure clients do not agree to unfavorable contract conditions or hidden margins and benefit from fair, low-margin pricing while actively looking for the best pricing possible from our supplier portfolio. Clients are provided options for the term and amount fixed that is best suited to their specific business needs and risk tolerance (e.g. a fully index, 50% fixed, or fully fixed products)